The Unified Trading Account (UTA) allows for borrowing and repayment of assets under specific conditions. This article explains how the system works, including how borrowing is triggered, how borrowing fee is calculated, and the repayment process.

Borrowing

Borrowing Fee

Repayment

Manual Repayment

Auto Repayment

View Borrowing, Borrowing Fee, and Repayment History

Borrowing

Borrowing under the UTA is automatically triggered under specific scenarios. Manual borrowing is not supported.

Formula

Borrowed Amount = ABS [Min (0, Equity − Asset Frozen)]

Borrowing Scenario

When the below scenario generates a borrowing amount, the system will process the auto borrowing of the asset.

Scenario | Example |

When the Spot Margin Trading function is enabled, assets are borrowed for Margin Trading | 1. Trader D has a wallet balance of 100 USDC and buys 300 USDC of BTC/USDC on Spot Margin Trading. 2. The auto-borrowed amount is 200 USDC. |

Borrowing Limit

All users are subject to a maximum borrowing limit shared across their Main Account and Subaccounts. Borrowing limits vary by coin and VIP tier. For more details, visit the Margin Data page.

For example, if the maximum borrowing limit for USDC is 2,500,000, the combined borrowing amount across the Main Account and two Subaccounts (A & B) must not exceed this limit. Exceeding this limit may trigger auto repayment.

Borrowing Fee

In Spot Margin Trading, actual Spot assets are borrowed to place orders. Regardless of whether an order is filled, any borrowed amount from Spot Margin Trading is considered realized borrowing, and the borrowing fee is charged. The borrowing fee will be accrued hourly once it is incurred. The system will auto-calculate and charge the borrowing fee five minutes after each hour, such as 8:05AM UTC or 9:05AM UTC, etc. This is based on the borrowing fee rate and the amount of borrowing at that time.

Formula

Hourly Borrowing Fee Charge = Borrowing Amount × Hourly Borrowing Fee Rate

Example

Trader A has placed a Spot Margin Trading BTC/USDC order and the borrowed amount is 10,000 USDC. Assuming the yearly borrowing fee rate is 5%, the hourly borrowing fee charge is calculated as follows:

10,000 USDC × 5% / 365 / 24 = 0.05707 USDC

Penalty Borrowing Fee

A penalty borrowing fee will be charged when your borrowing amount exceeds 100% of the maximum borrowing limit. The formula is:

Formula

Penalty Borrowing Fee Payment = Borrowing Amount × Hourly Borrowing Fee Rate × (utilization ratio)3

Example

If the borrowing amount is 3,000,000 USDC and the maximum borrowing limit is 2,500,000 USDC with an hourly borrowing fee rate of 0.0001%, the penalty borrowing fee charge is calculated as follows:

Utilization Ratio = 3,000,000 / 2,500,000 = 120%

Penalty Borrowing Fee = 3,000,000 × 0.0001% × (1.2)3 = 5.184 USDC

Repayment

Manual Repayment

Currently, traders can perform manual repayments on the UTA via the few methods stated below:

1. Use Repay Button: Go to UTA and click on the Repay button for repayment. A 0.1% repayment handling fee (conversion fee from margin assets into borrowed coins) on the total repayment amount will apply. For more details, please visit here.

2. Deposits or Transfers: Deposit or transfer assets in the respective borrowed amount from another account to your UTA. The borrowed amount will be deducted from your wallet balance immediately.

3. Selling Assets: Sell margin assets via Spot Trading into the assets you borrowed. However, please note that if the Initial Margin Ratio (IMR) is 100%, traders are not allowed to place orders to buy assets with a lower collateral value ratio using assets with a higher one. You can view the collateral value ratio from here.

Auto Repayment

If auto repayment is triggered, the system will automatically convert other positive balance assets into the borrowed coin based on the index price to repay the loan.

Auto-Repayment Scenarios

Auto repayment will be triggered in the following scenarios:

1. Maintenance Margin Rate (MMR) ≥ 100%:

- The system will partially repay the liabilities until the MMR returns to the 85%‒90% range.

- If partial repayment fails to bring the MMR within this range, a full repayment will be executed.

- A 2% handling fee will apply on top of the repayment amount.

2. Exceeding Maximum Borrowing Limit: When the maximum borrowing limit is hit, the auto repayment process will be triggered until the borrowed amount is reduced to 90% of the maximum borrowing limit, with a 1% repayment handling fee. Among all accounts with borrowings, the system will prioritize repayment in descending order, starting with the accounts having the highest borrowed amount and proceeding to those with the lowest.

Auto-Repayment Process

Bybit EU supports a delayed automatic repayment mechanism, which only applies to the scenario of users exceeding the maximum borrowing limit.

When the borrowing limit reaches 100%, the system sends an email notification to the traders as a reminder. Once your borrowed amount falls below 100% of the maximum borrowing limit, your account will return to a safe level. However, if the account's borrowed amount remains at or above 100% of the limit for a continuous 24-hour period or reaches 200%, whichever comes first, the system will initiate the automatic repayment. Note that for scenarios where the MMR is ≥ 100%, the delayed automatic repayment mechanism does not apply.

The auto repayment process is as follows:

Step 1: The system will cancel the active orders from Spot/Spot Margin Trading (i.e., limit orders or TP/SL orders) that occupy the borrowed assets to free up frozen balances.

Step 2: Assets with positive equity and without any borrowed amount under the UTA will be auto converted into the assets in liability for repayment, without canceling the Spot/Spot Margin active order. Assets will be sold according to the liquidity sequence stated here.

Step 3: Cancel the Spot/Spot Margin active order to free up the frozen balance of other coins according to the liquidity sequence to auto-exchange into the assets in liability for repayment.

Notes:

— Auto-repayment will proceed through Step 1 to Step 3 until the borrowing amount is reduced to 90% of the maximum borrowing limit (for exceeding the maximum borrowing limit scenario) or until all liabilities are fully repaid (for MMR ≥ 100% scenario).

— In the case where traders have borrowings in multiple coins, the system will repay the non-stable coins first according to the liquidity sequence, followed by stablecoins.

View Borrowing, Borrowing Fee, and Repayment History

Borrow History

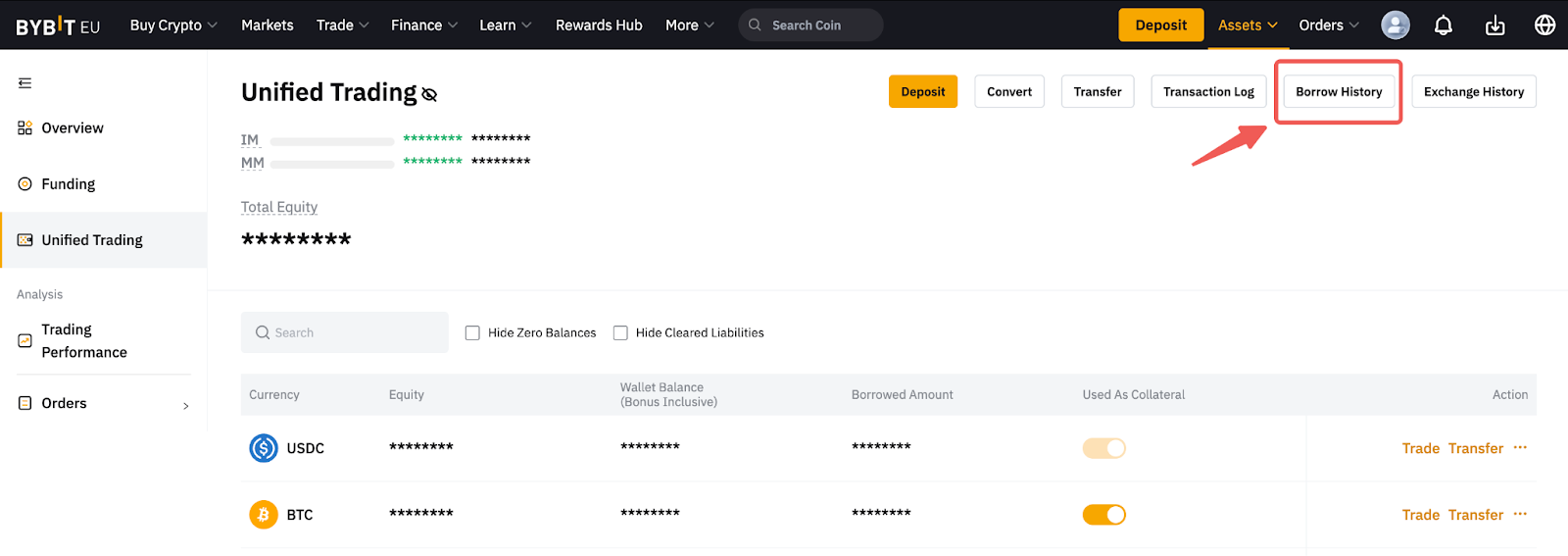

On the Website, go to your Unified Trading Account asset page and click on Borrow History.

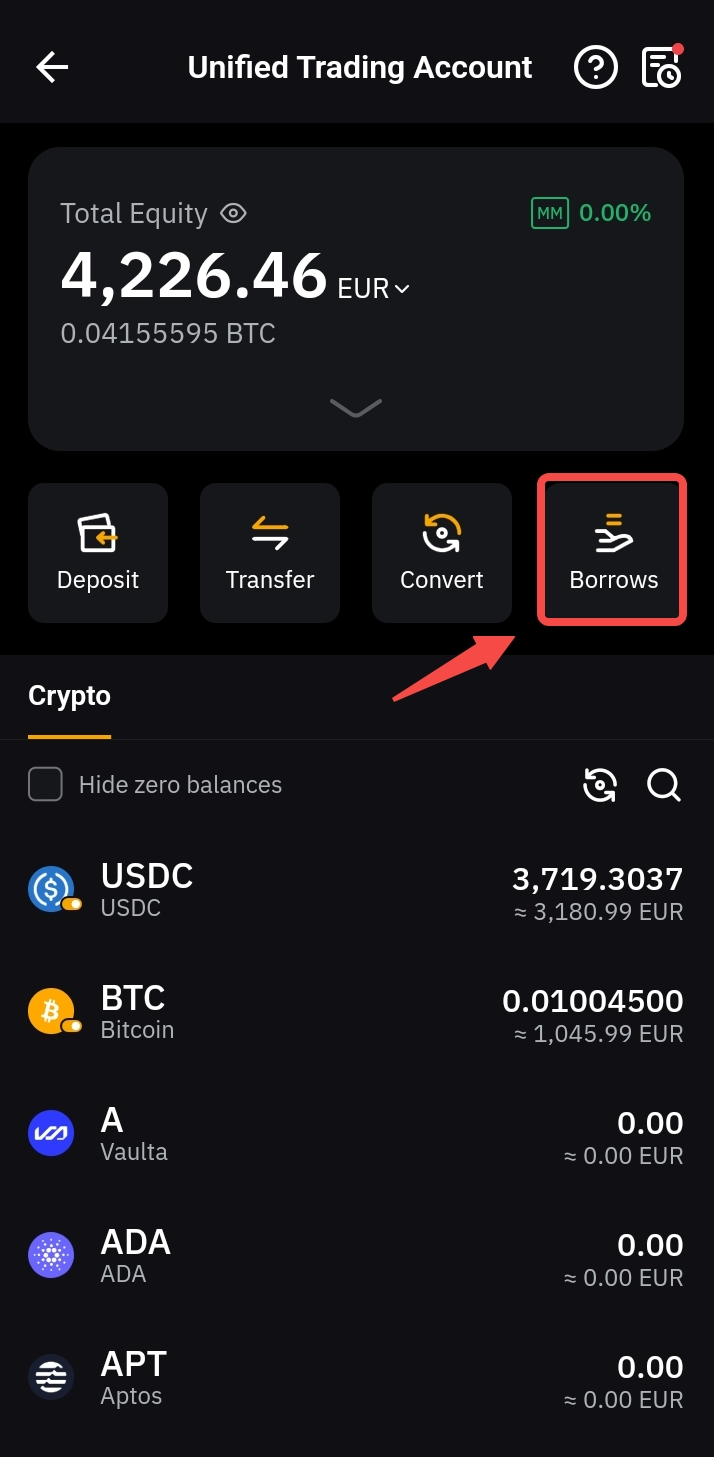

On the App, go to the Assets page → Unified Trading Account and tap on Borrows to view the borrowing history.

On the Borrow History, you can see the borrowing details under each coin, including the borrowed amount, hourly borrowing fee rate, maximum borrowing amount, utilization ratio, and borrowed amount (interest-free).

- Maximum borrowing amount: The maximum borrowing limit for each coin, and this limit is shared among your Main Account and Subaccounts.

- Utilization Ratio: This shows the utilization ratio of your borrowing limit across your Main and Subaccounts.

- Borrowed Amount (Interest-Free): This shows the borrowed amount arising from unrealized loss and the amount that is exempted from the borrowing fee charge.

Borrowing Fee Record and Repayment History

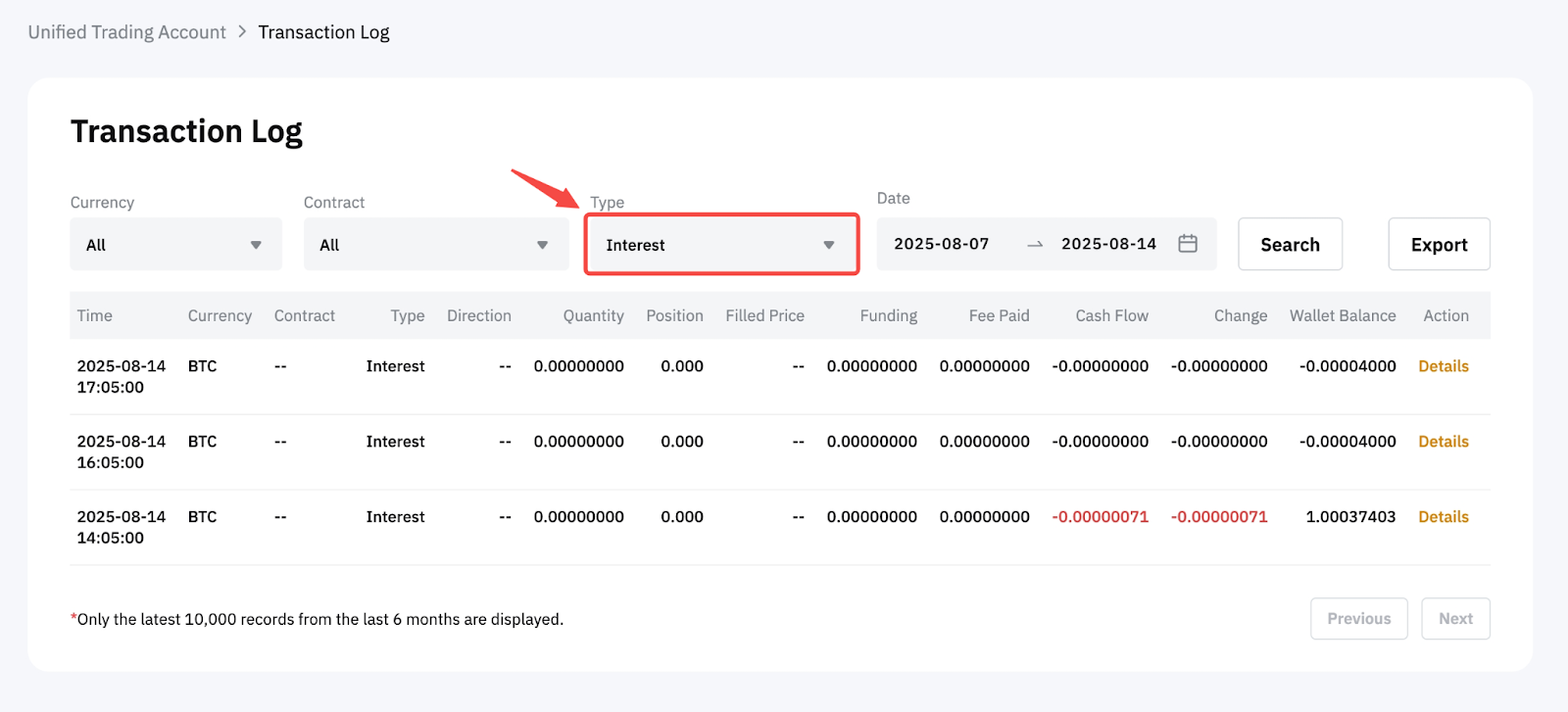

On the Website, go to your Unified Trading Account asset page and click on Transaction Log. You can filter the Transaction Type to Interest to view the borrowing fee charged. For manual or auto repayment, you can refer to Sold for Repayment or Bought for Repayment.

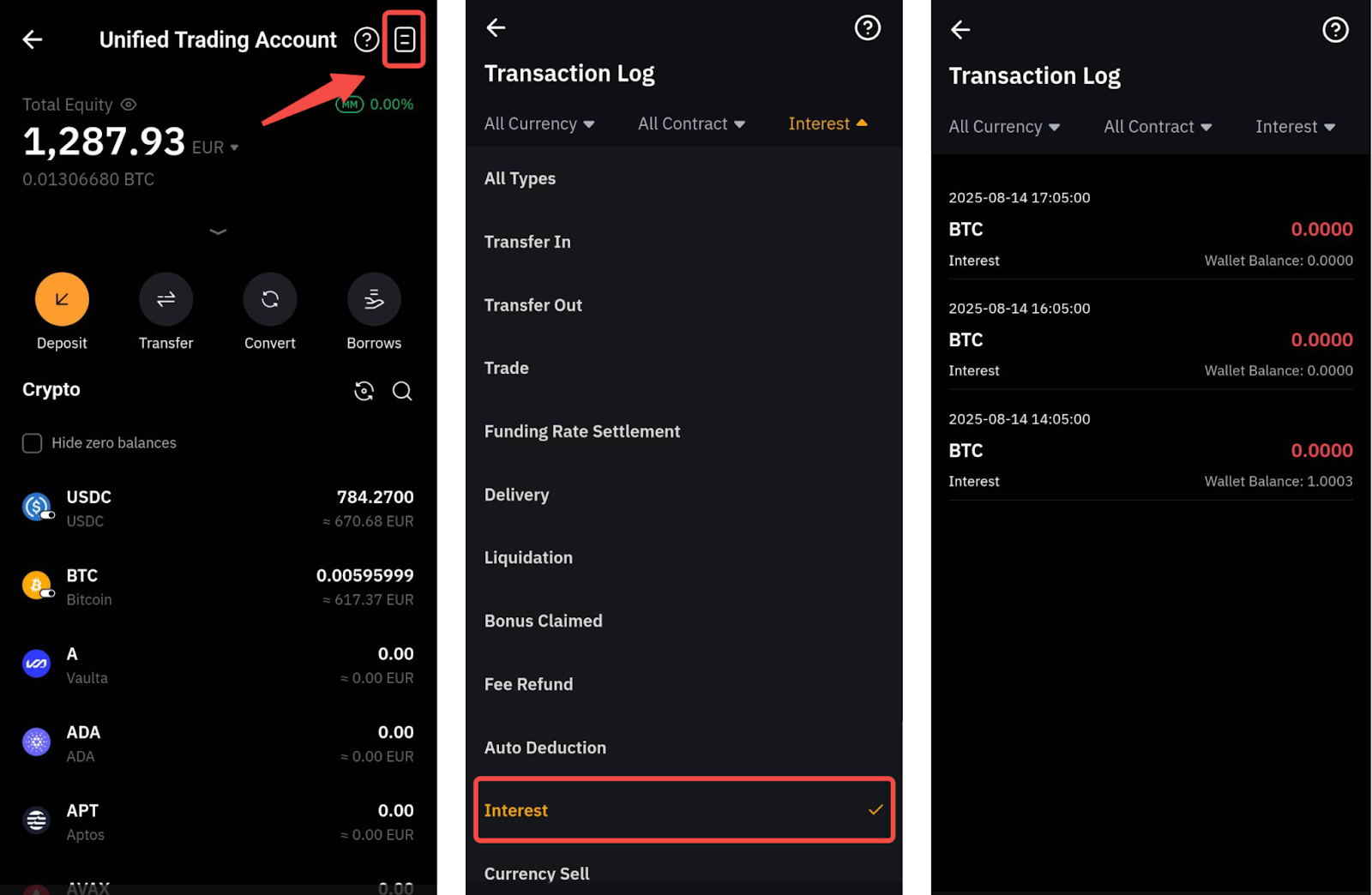

On the App, go to Assets → Unified Trading Account → Transaction log and filter the respective transaction types.

To learn more about how to view your repayment history, please refer to here.