What should I do if I notice a transaction that was not initiated by me?

- Do an online search for the name of the unfamiliar merchant, as they may have a different name from their registered business name.

- If you are sure that you did not make the transaction, please report your Bybit Card as lost/stolen immediately. After you freeze your Bybit card, please submit the transaction dispute as soon as possible, and no later than 60 days from the transaction date.

- If you cannot log in to your Bybit EU account, please reach out to Bybit EU Live Chat Support immediately.

What are some fraud prevention tips for my Bybit Card?

- Do not share your Bybit Card or account information with anyone.

- Do not save your Bybit Card or account credentials on your devices.

- Freeze your Bybit Card when you are not using it (you can use it immediately upon unfreezing).

- Ensure the information of the authentication prompt is correct before you authorize any transaction.

If you notice an unauthorized transaction, please report your Bybit Card as lost/stolen immediately.

What should I do if my Bybit Card is lost or stolen?

Please report your Bybit Card as lost/stolen immediately. To learn more about how to process, please refer to Security and Verification.

Can I pay in installments with Bybit Cards?

Installment payments are not supported on Bybit Card.

How long does it take for the transaction amount to be deducted from my Funding Account after my Bybit Card transaction is authorized?

Once your Bybit Card transactions have been successfully authorized, the transaction amount in your Funding Account will be frozen and only deducted once the merchant completes the transaction. Please note that it will take up to 30 days.

If you opt not to wait within the provided time frame, you may contact the respective merchant directly and request cancellation of the transaction. Alternatively, we appreciate your understanding and patience as we await completion of the transaction by the merchant.

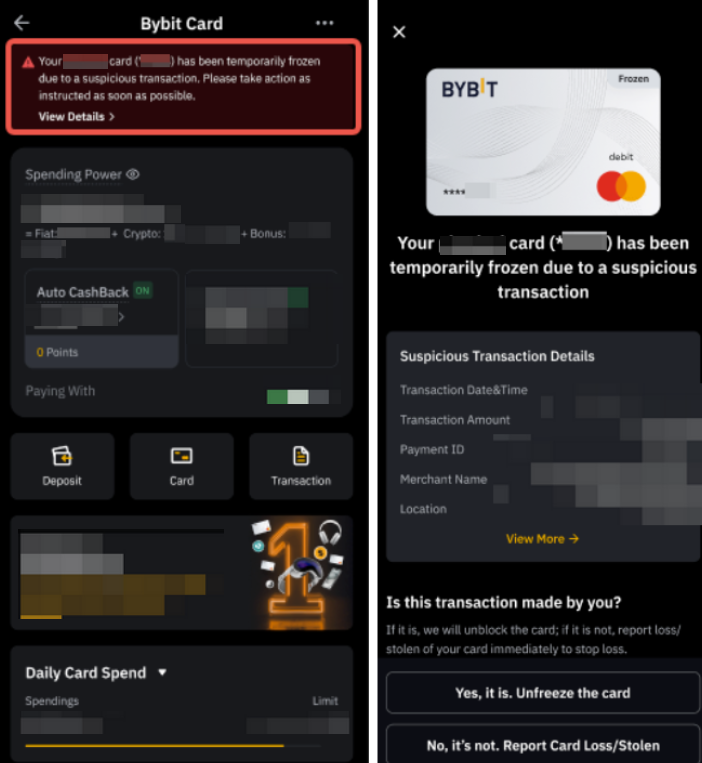

I made a payment requiring 3DS with my Bybit Card and it was unsuccessful. What can I do to authorize the transaction?

When making payment requiring 3DS, Bybit Card users will need to enable biometrics to authorize the transaction within 120 seconds.

If you have not enabled biometrics, you will be redirected to enable it within 60 seconds. You will have 4 attempts to enable biometrics, each attempt lasting 60 seconds. If you need a fifth attempt, you will be prompted to complete authentication through an email verification code on the transaction page. After verifying the email OTP, you will be asked to select a recent payment from the list.

Am I able to switch the Bybit Card transaction verification method from biometric verification to email authentication?

Yes, you are able to switch to the email authentication method if you are holding a Bybit Card. Kindly refer to the following instructions:

- When your Bybit Card transaction is redirected to the page below, you may click on the Receive Email button to switch to email authentication.

- Once you have clicked on the Receive Email button, you will receive an email with a verification code. Enter the code on the page and click Submit Code to complete the transaction.

- After you have verified with the email code, you will be prompted to complete a security step by answering the question on the page to protect your account.

- Please note that if the incorrect answer is provided, the transaction will be canceled, and you will need to initiate the payment again.

Why was my transaction declined?

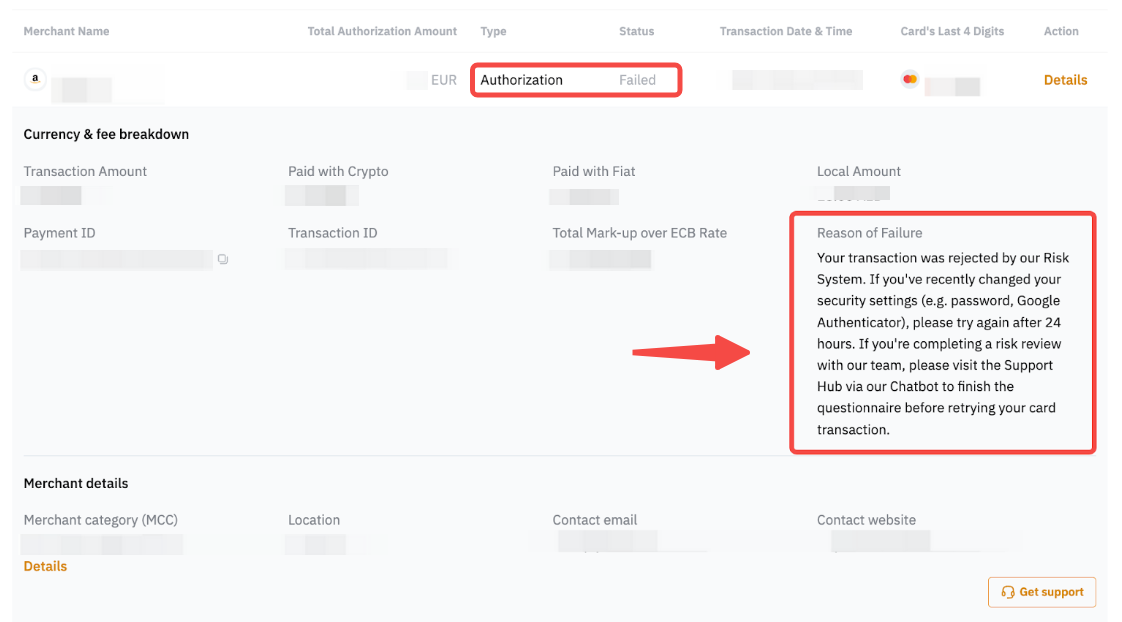

To check the declined reason, go to your Bybit Card Transaction History → Authorization → Details of the respective transaction.

Transactions can be declined due to several common reasons below:

For other declined reasons not stated above, please submit your inquiry via the webform.

How to dispute a transaction?

If your transaction has already been completed, we recommend that you contact the merchant directly to communicate or request a refund.

Can I pay for products and services in foreign currencies?

Yes, you can pay for products and services in foreign currencies. We will convert the transaction amount into the denominated currency using the MasterCard foreign exchange rate on the day they process the transaction. Please refer to the Fees and Limits (Bybit Card) for information on the foreign exchange fee.

Note: You may notice the amount authorized is slightly higher from the actual transaction amount. This is due to a padding applied when freezing your funds for authorization to accommodate changes in the exchange rate when the merchant completes the transaction. Any excess amount not deducted by the merchant will be unfrozen. Please refer to the Fees and Limits (Bybit Card) for the padding fee.

What is the Total Markup over ECB Reference Rate?

The Total Markup over ECB Reference Rate reflects the difference between what you pay for your Bybit Card transaction using Mastercard foreign exchange rates and fees, and what you would pay if the transaction was undertaken at the European Central Bank Reference Rate.

Why does my Funding Account have a negative balance?

There are several common reasons that may cause a negative balance in your Funding Account:

- The foreign exchange rate at the time of settlement is higher than the estimated rate during authorization, and there are insufficient funds to cover the difference

- The final transaction amount charged by the merchant is higher than the authorized amount, and there are insufficient funds to make up the difference

When you have a negative balance in your Funding Account, your Bybit Card will be suspended and withdrawals from your Bybit EU account will be restricted. In order to lift the restriction, please repay the negative amount as seen in your Spending Power or Funding account as soon as possible. You can repay the negative amount by selecting Deposit Crypto from the payment method list for your Bybit Card. Please be informed that, once you have repaid the negative balance, the restrictions will be lifted within 24 hours.

If you have further questions, please submit your inquiry via the webform and select My Bybit card is suspended as the inquiry option.

Why is my Bybit Card transaction stuck at the authorization stage for days?

The authorisation is currently waiting for the merchant’s capture and it may take up to 30 days for your payment to be processed. Your funds will remain frozen during this period. You may contact the merchant for more information.

Why is my Bybit Card refund not credited to my account yet?

Under normal circumstances, refunds will be processed and credited to your Funding Account within 2 business days.

In certain cases, additional information may be required before processing your refund. Please check your email for instructions or visit the Support Hub page for details. Upon submission, your refunds will be reviewed and credited to your Funding account within 2 working days. You will be notified of the review outcome via email, and updates will also be available on the Support Hub.

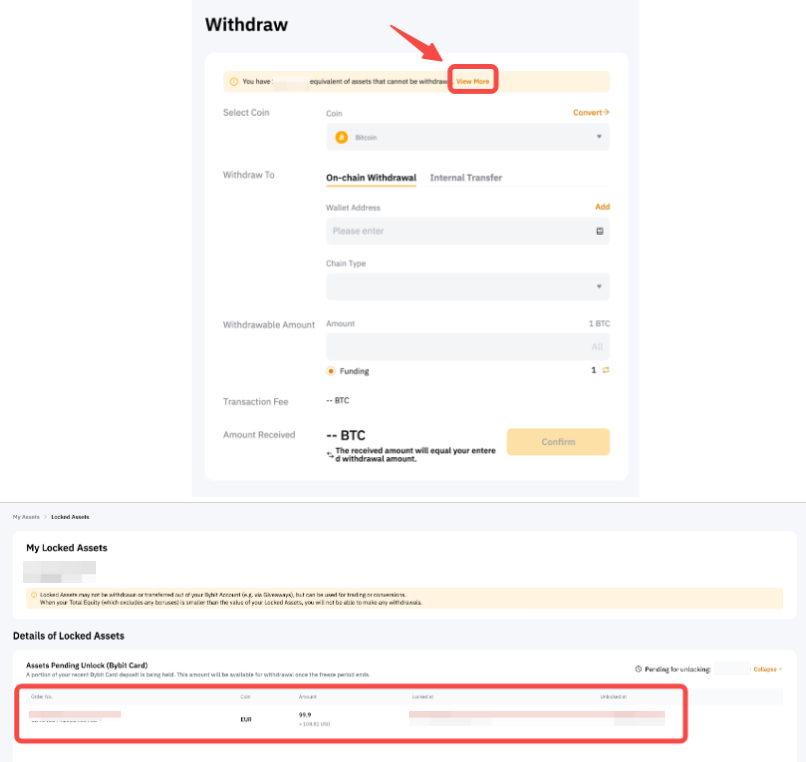

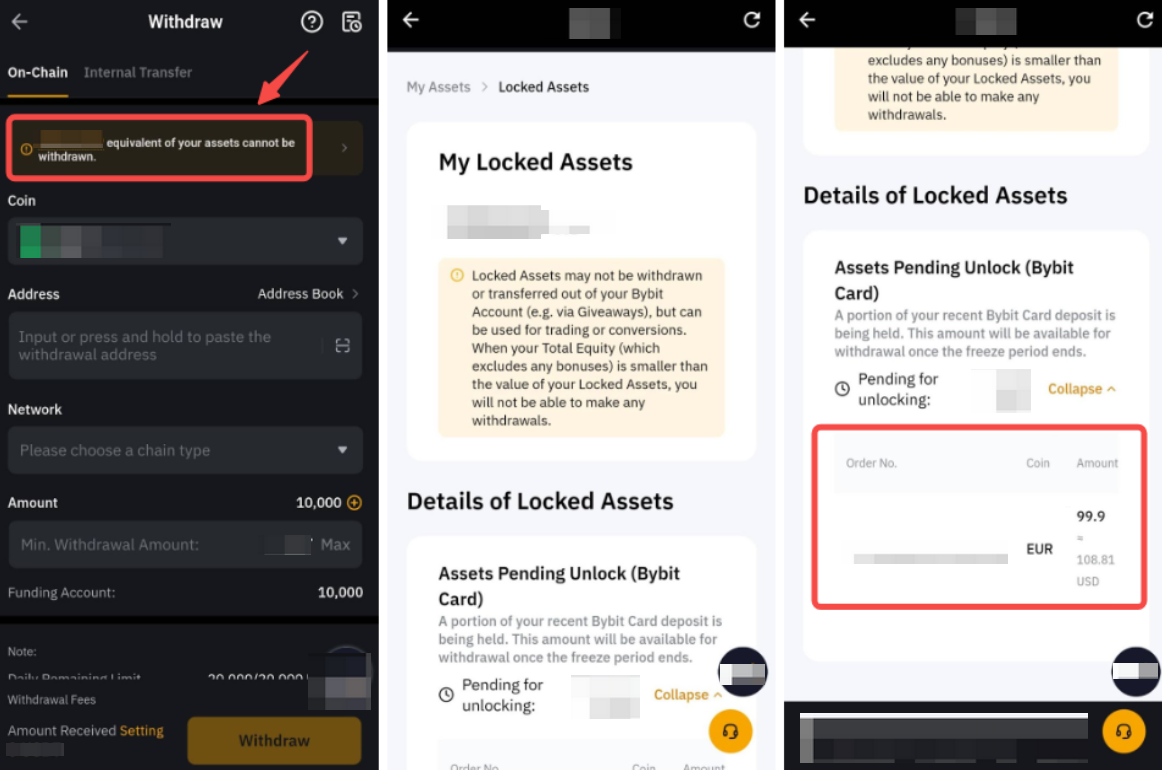

Why are my funds frozen for 24 hours?

To protect the security of your funds, any direct deposits to the Bybit card will be frozen for 24 hours. You can check the details on the My Locked Asset page.

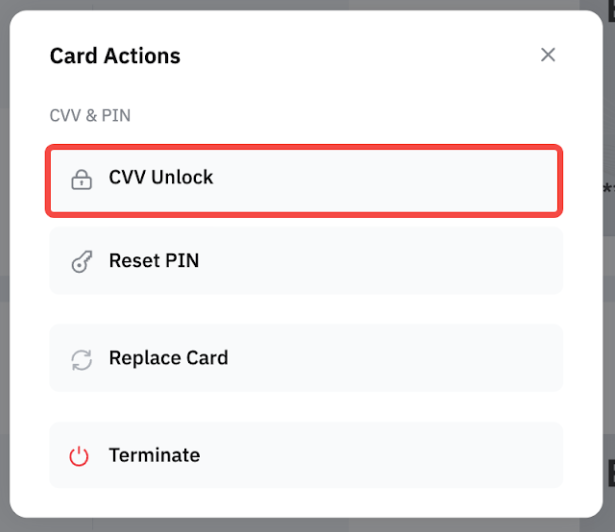

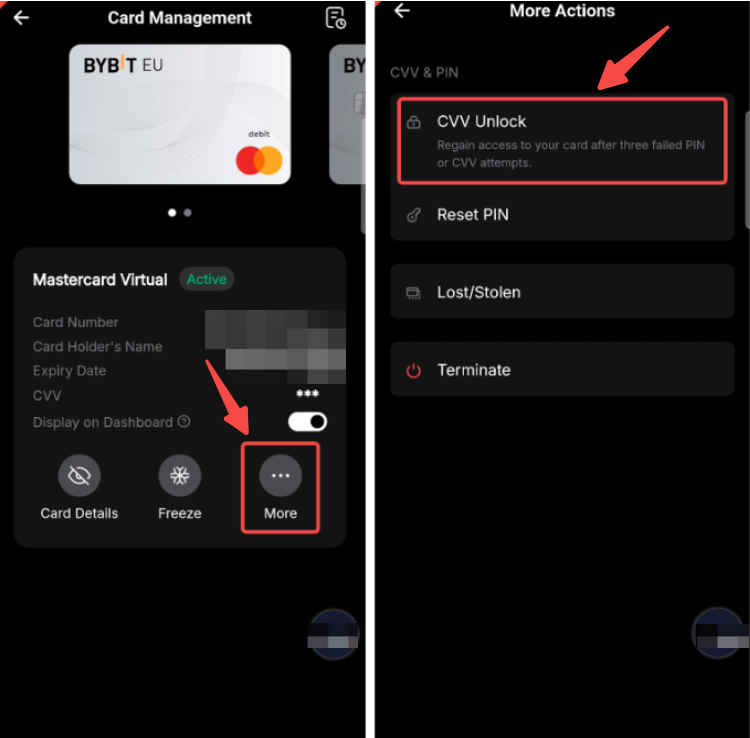

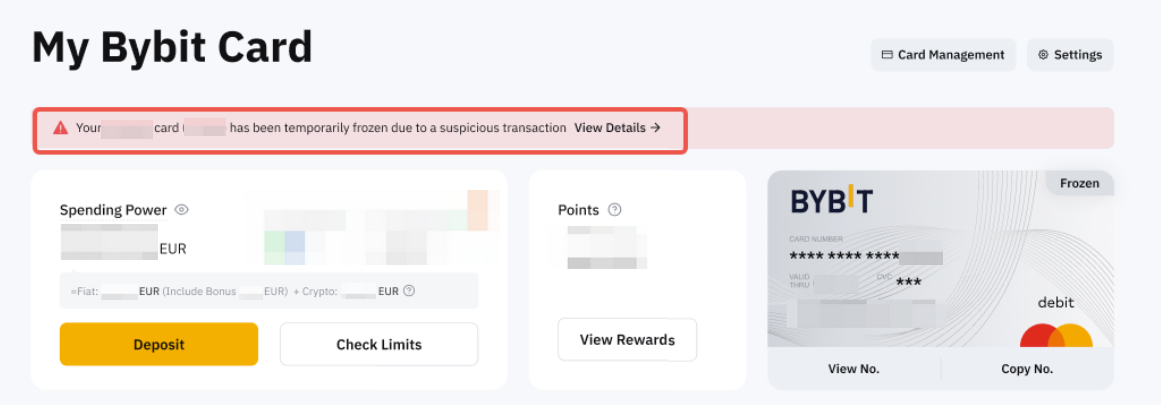

Why is my card frozen after receiving the alert “Your virtual/physical card (****) has been temporarily frozen due to a suspicious transaction”?

To ensure your account's security, if we detect any suspicious activity, we will notify you to confirm whether the current transaction is authorized by you.

If it was not you, please follow this guide to terminate the transaction and reapply for the card.

If it was you, please authorize the transaction. The system will unfreeze your card immediately.

In what currency are refunds returned to my Funding Account?

Refunds will be returned to your Funding Account, in the currency your card is denominated (EUR).

Does Bybit EU deduct my points in the event of a refund?

In case of refunds, Bybit EU reserves the right to deduct your points earned from the original purchase transaction.

Where to check my available balance for Bybit Card spending?

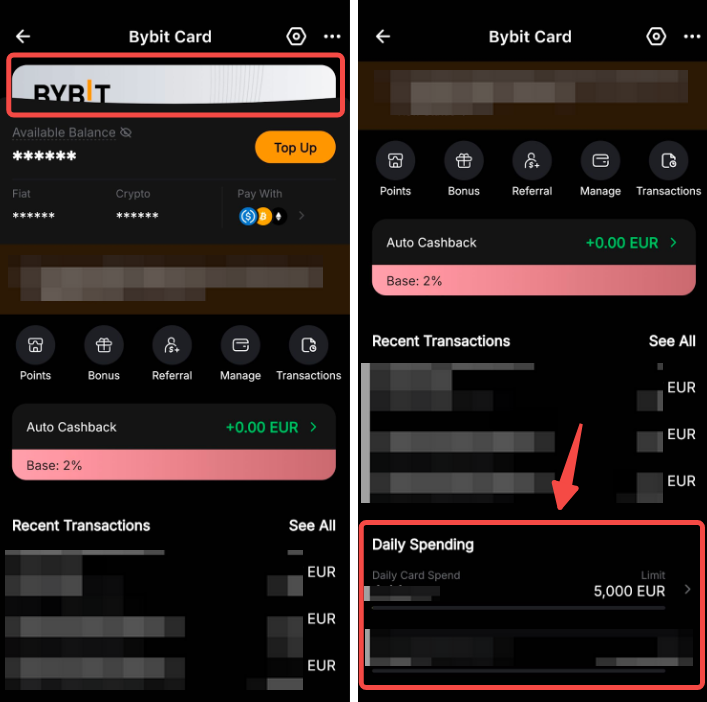

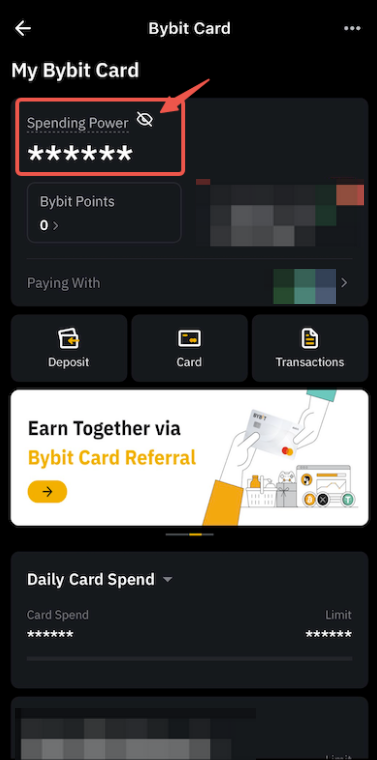

Turn on the eye icon located next to Spending Power on the Bybit Card Dashboard.

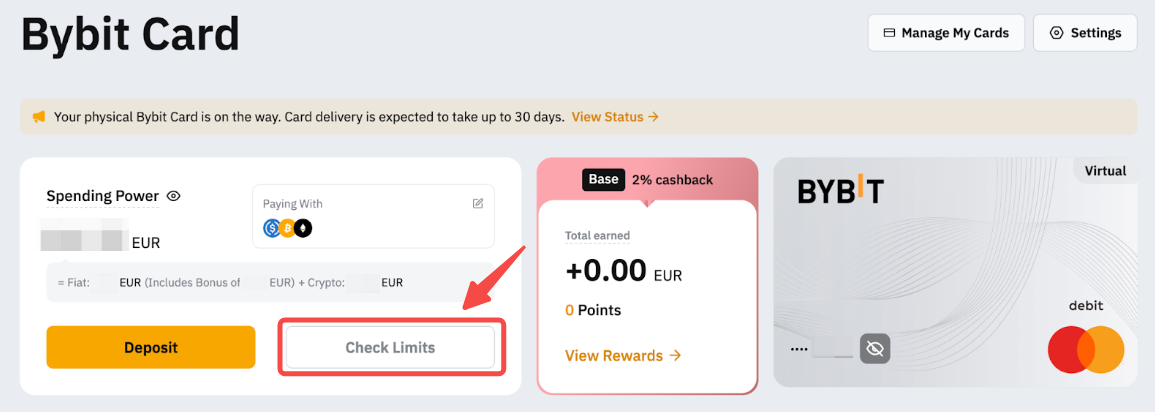

Where to check my Bybit Card Spending and ATM Limit?

Click on Check Limits on Bybit Card Dashboard and select if you want to check the card and ATM limit.

If you are using Bybit EU App, turn on the eye icon located next to Spending Power on the Bybit Card Dashboard and scroll down to check the card and ATM limit.