Bybit EU has replaced the current fixed borrowing fee rate system with a floating borrowing fee rate system. This allows us to ensure that our borrowing fee rates always reflect current market conditions.

This floating borrowing fee rate system will be applicable to our loan services such as Spot Margin Trading and Unified Trading.

How are borrowing fee rates derived?

The borrowing fee rates are derived from the capital utilization rate, which is an indicator of the availability of capital in the asset pool for loans, based on the following model:

If Capital Utilization Rate < Capital Utilization Rate Threshold:

Annual Borrowing Fee Rate = Base Annual Borrowing Fee Rate + (Capital Utilization Rate/Capital Utilization Rate Threshold) × Variable Rate Slope 1

If Capital Utilization Rate ≥ Capital Utilization Rate Threshold:

Annual Borrowing Fee Rate = Base Annual Borrowing Fee Rate + Variable Rate Slope 1 + (Capital Utilization Rate - Capital Utilization Rate Threshold) / (1 - Capital Utilization Rate Threshold) × Variable Rate Slope 2

The capital utilization rate threshold, base annual borrowing fee rate and variable rate slope stated above are all fixed values and will be reviewed periodically according to market conditions, while the capital utilization rate will be calculated based on real-time lending conditions.

Capital Utilization Rate = Loaned Assets / Total Asset Pool × 100%

How often are borrowing fee rates updated?

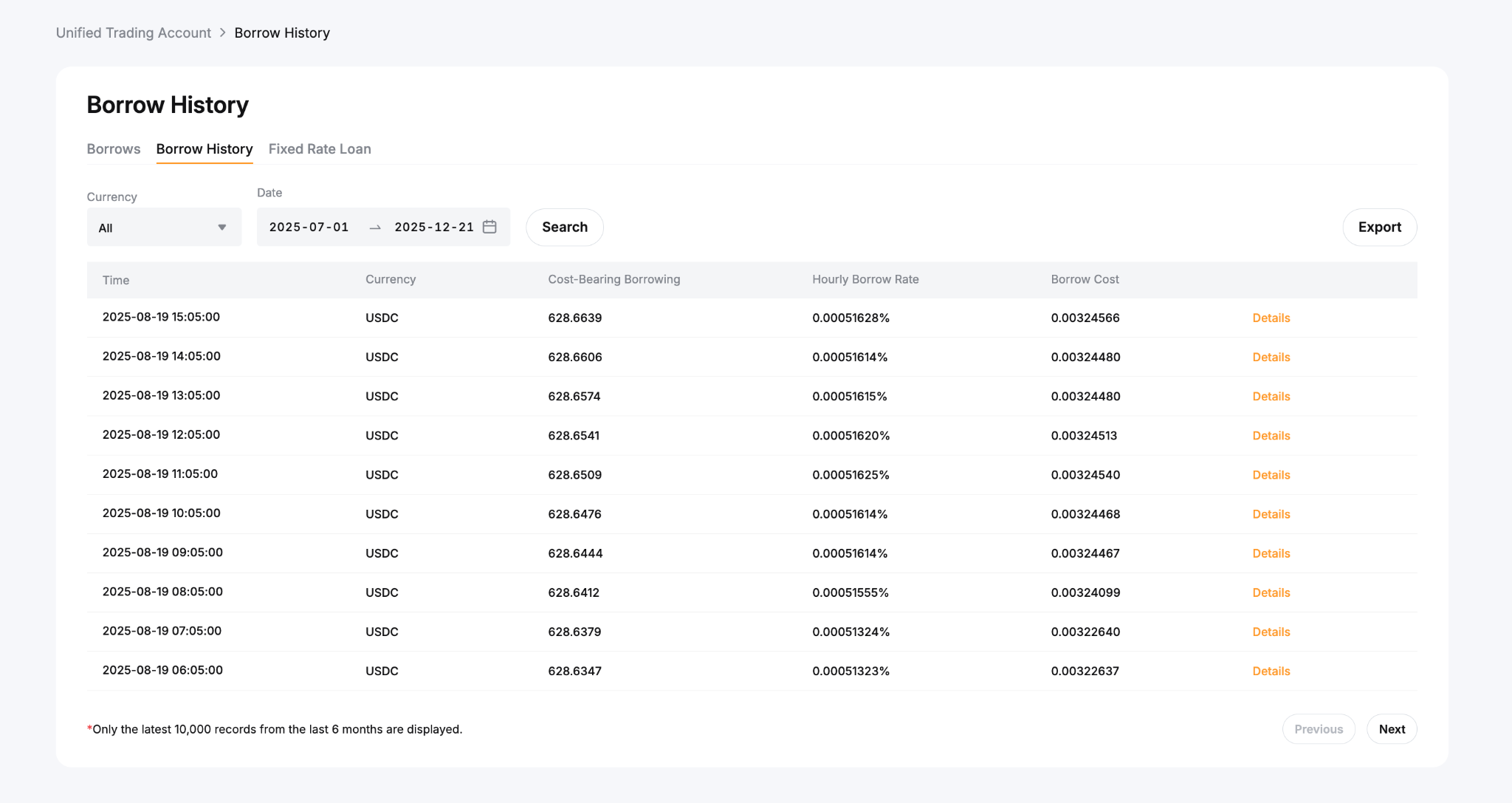

Borrowing fee rates will be updated every hour based on current market conditions.

How is the borrowing fee charged?

Formula: Borrowing Fee Payment = Amount to Borrow × Hourly Borrowing Fee Rate

The borrowing fee charge remains unchanged. Borrowing fee will be accrued immediately and once every hour after you’ve successfully borrowed funds. The borrowing fee is calculated according to the actual borrowing hours and the borrowing fee rate displayed when borrowing. The system will automatically calculate and charge a borrowing fee five (5) minutes after each hour, such as 8:05AM UTC and 9:05AM UTC, etc.

Read More

Borrowing, Borrowing Fee and Repayment

How will I be impacted?

Given that borrowing fee rates may fluctuate according to market conditions, we strongly recommend users closely monitor applicable borrowing fee rates and LTV levels or account Maintenance Margin rates to avoid any potential liquidation due to large borrowing fee rate fluctuations and/or borrowing fee accruing over time.

Where can I find the latest borrowing fee rates?

All borrowing fee rates applicable on Bybit EU can be found under Lendings and Borrowings on the Bybit EU Market Overview page but there is also direct access to this data from the product pages.

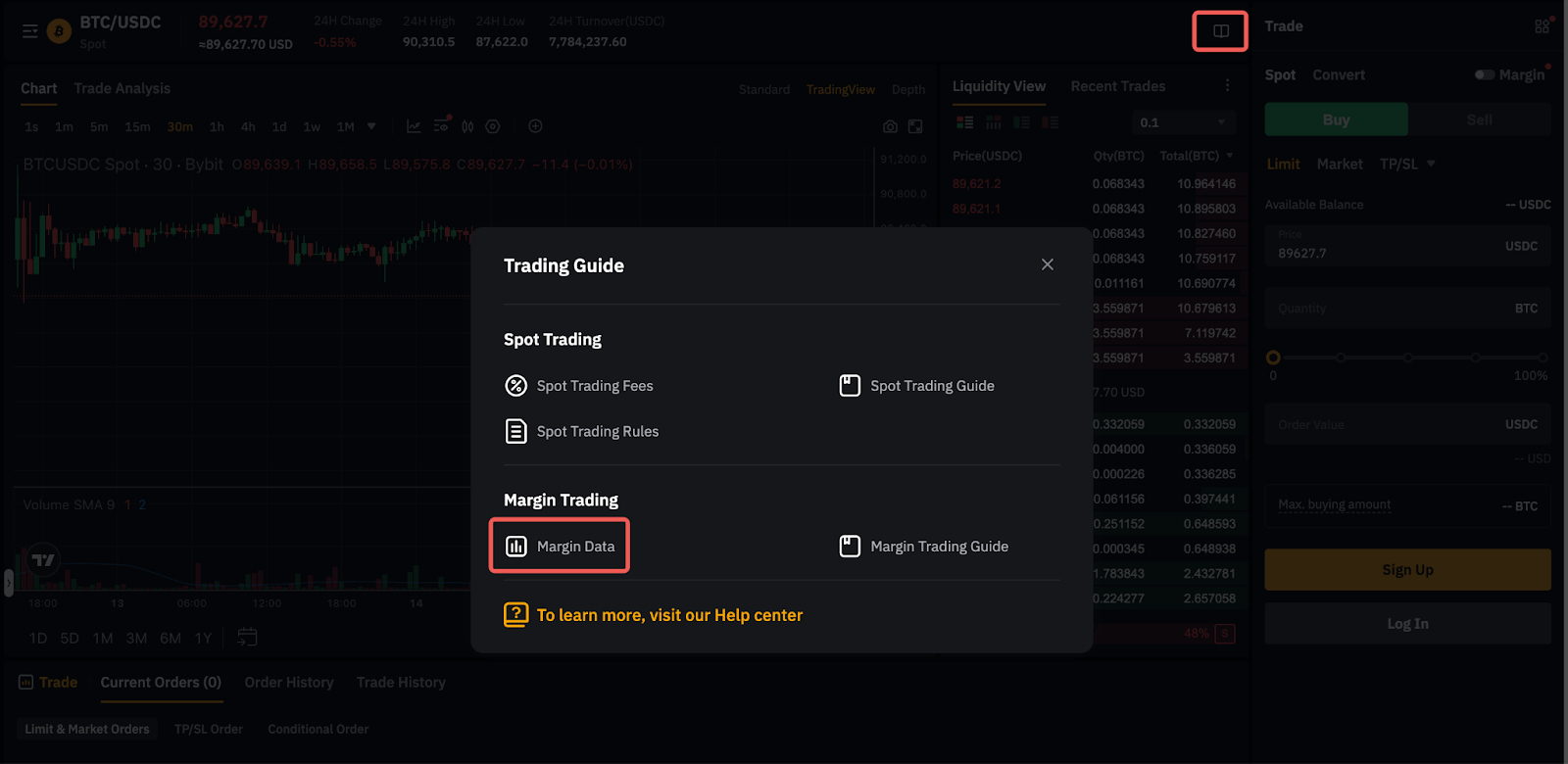

For Spot Margin Trading, please click on Trading Guide → Margin Data to view the latest borrowing fee rates. You can also view the borrowing fee rates for different VIP levels.

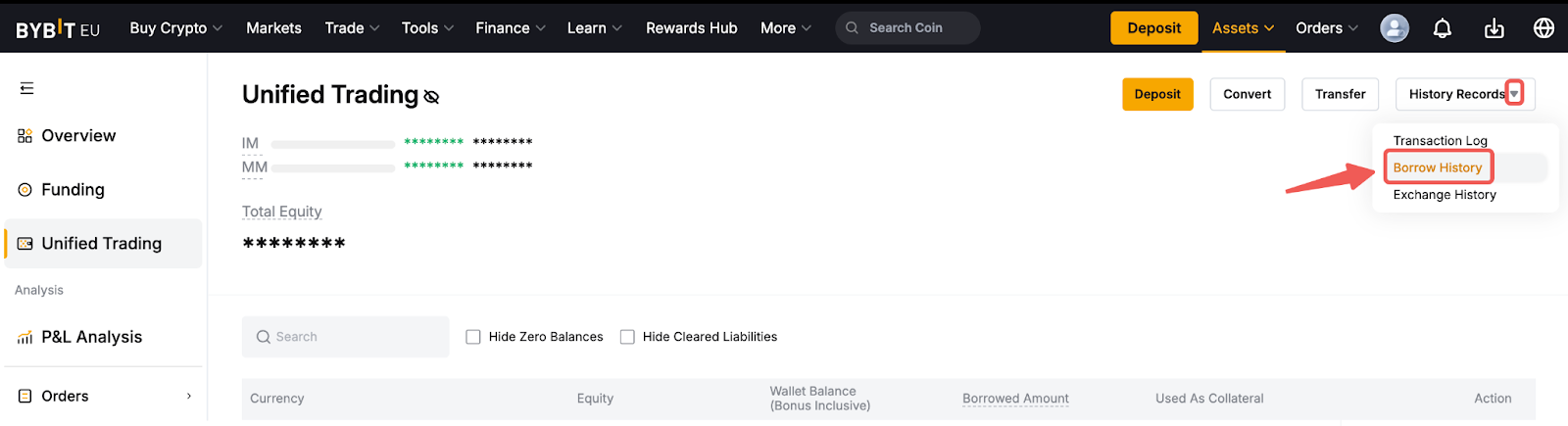

Alternatively, please go to Unified Trading Account → History Records → Borrow History. There, you will be able to see your hourly borrowing fee rate and the details of your borrowing.