There are three types of fees that can be incurred when Margin trading: Spot trading fee, borrowing fee and liquidation fee.

Spot Trading Fee

Trading fees are charged when buying or selling on the Spot Margin market. The fee structure is the same as for Spot trading.

Formula

Trading Fee = Filled Order Quantity × Spot Trading Fee Rate

Please note that makers and takers who are non-VIP users pay a trading fee of 0.1% in the Spot market. The higher your tier, the lower the fee rates you're entitled to.

To learn more about Spot trading fees, please refer to the following articles:

Borrowing Fee

The borrowing Fee incurred while Margin Trading is generated on an hourly basis. You can repay the loan at any time and pay borrowing fee for the actual borrowing hours. Please note that an increment of one hour will be counted as one hour.

Formula

Borrowing Fee = Amount to Borrow × Daily Borrowing Fee Rate / 24 × Hours

Example

Suppose Trader A borrows 10,000 USDC at 8:05 AM UTC and repays at 10AM UTC.

Daily Borrowing Fee Rate: 0.02%

Hourly Borrowing Fee Rate: 0.02% / 24

Trader A needs to pay borrowing fee of 0.167 USDC based on the following calculation:

Borrowing Fee = 10,000 × 0.02% / 24 × 2

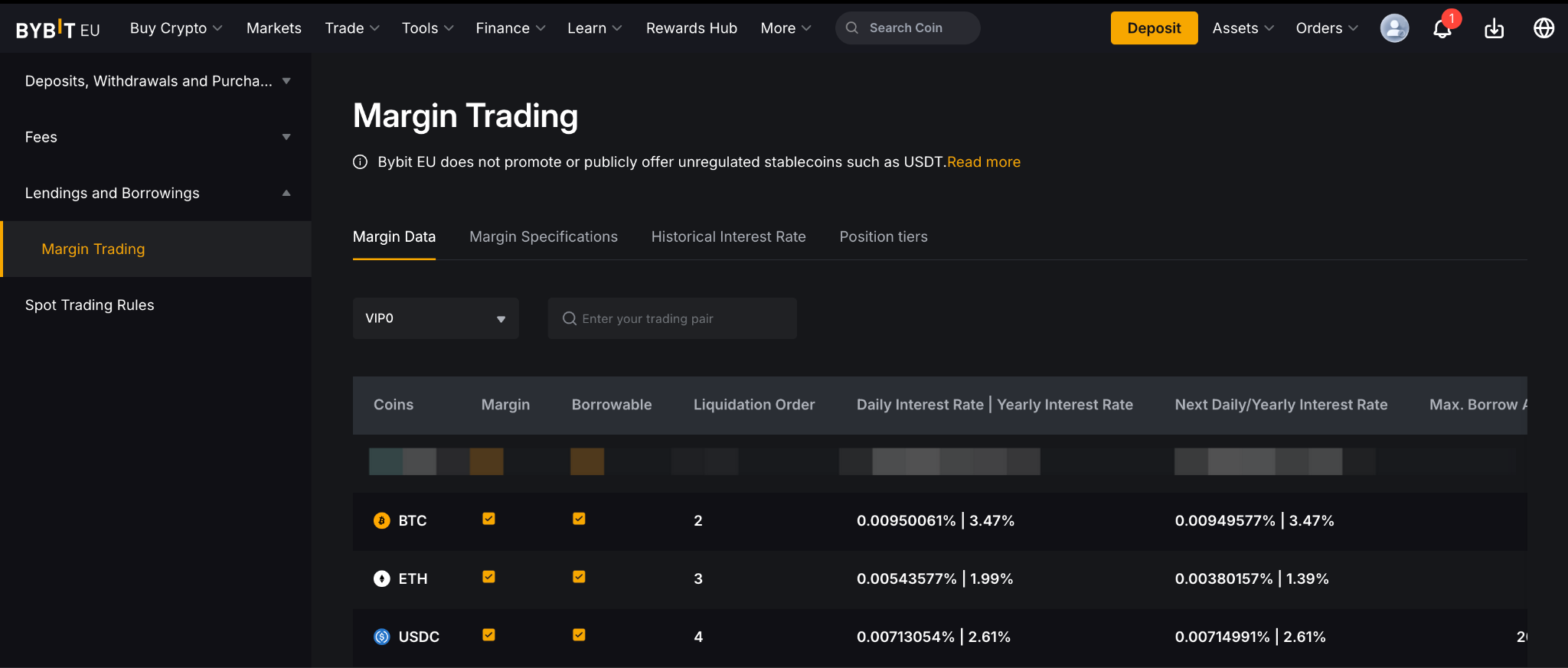

Please note that borrowing fee rates vary daily. In addition, each VIP level will enjoy different daily and yearly borrowing fee rates. You can refer to the daily borrowing fee rate, yearly borrowing fee rate and maximum amount to borrow for each coin here.

Notes:

— Borrowing fee will be generated immediately after you've successfully borrowed funds. It will be incurred regardless of whether the order has been filled.

— Please complete the repayment in time to avoid long-term unpaid borrowing fee in your Unified Trading Account which may increase the risk level of your Unified Trading Account.

Liquidation Fee

When Spot Margin Trading, liquidation fees will be charged and injected into the margin insurance fund pool.

In an event where your account goes bankrupt, i.e., when you are liquidated, you have insufficient margin assets in your Unified Trading Account to repay the debt. The platform will use the margin insurance fund to cover your outstanding balance.

Formula

Liquidation Fee = Liquidated assets × Liquidation Fee Rate

Liquidated Assets = Liquidated Quantity / (1 + Liquidation Fee Rate)

Example

Liquidation has been triggered and the liquidated value is 93.8069873440 USDC.

The calculation is as follows:

Liquidated asset = 93.8069873440 / (1 + 0.02) = 91.96763465 USDC

Liquidation fee = 91.96763465 x 0.02 = 1.8393526930 USDC