What is Margin Trading?

Margin Trading on Bybit EU is a product based on Spot trading. It allows you to use assets in your Unified Trading Account as collateral to borrow additional funds from Bybit EU, to buy or sell spot assets larger than your wallet balance. Margin Trading allows you to earn higher returns with lower capital but also bears higher risks. Traders will be exposed to liquidation risk and must maintain a certain amount of collateral in their accounts.

Where can I access Spot Margin Trading?

On the web, you can go to Spot Trading and switch on the Margin tab, while on the App, you can go to the Margin tab directly. You will see a leverage indicated beside the symbols. For more details, please refer to How to Get Started With Spot Margin Trading.

Which margin mode supports Margin Trading?

Margin Trading is only supported in Cross Margin and Portfolio Margin mode. It is not supported in Isolated Margin mode.

Which coins can be used as collateral and borrowable assets for Margin Trading?

You can refer to the Margin Data for the supported collateral and borrowable assets.

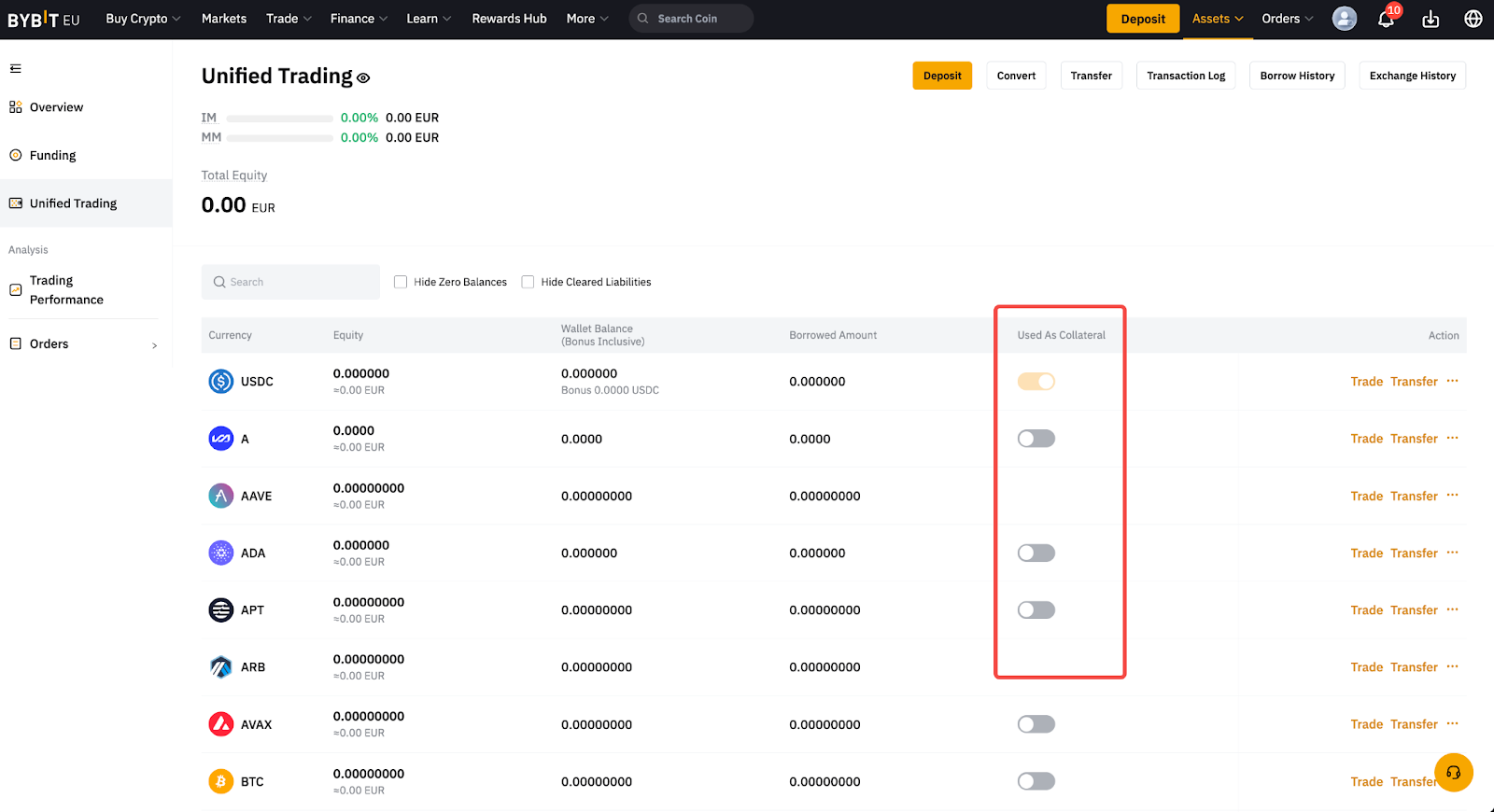

Why couldn’t I make any borrowings (amount to borrow = zero) even after enabling the Margin trading?

This might be due to the base or quote token of the trading pair not being enabled as a collateral asset. For example, to trade BTC/USDC in Margin Trading, you need to enable both BTC and USDC as collateral assets from the Unified Trading Account asset page. With more collateral assets enabled, you will be able to borrow more.

How to borrow funds in Margin Trading?

Borrowing in Margin Trading is automatically triggered when you place an order with a quantity or value greater than the available wallet balance you have. You can view the amount to borrow stated on the order window.

Will an unfilled limit order incur borrowings?

Yes. In Spot trading, transactions involve the actual exchange of assets. When you place a limit order, the system will reserve the required funds or assets for that order immediately — even if the order is still pending execution. If your available wallet balance is insufficient at that moment, the system will borrow the shortfall, which means borrowings may occur and borrowing fee accrued before the order is filled.

Will the borrowings be repaid automatically if I cancel my unfilled limit order?

Yes. When you cancel such an order, the borrowed amount will be returned immediately. However, any borrowing fee that has already accrued during the period the funds were borrowed will still be charged.

What is the maximum leverage available in Spot Margin trading?

The maximum leverage for Spot Margin trading is 10x. Depending on the leverage you choose, certain user groups may be required to complete different types of quizzes before using that leverage. If prompted, please follow the on-screen instructions to complete the required quiz.

How to derive the Available Balance on Margin Trading?

Available Balance on Margin Trading refers to the amount you can use to place new margin trading orders. This includes both your available wallet balance and the maximum amount you can borrow. The system calculates AB based on your Initial Margin Rate (IMR) limit, which depends on your selected leverage. The formula is (Selected Leverage − 1 / Selected Leverage).

For example, if you select 10x leverage, (10-1/10) = 90%, the system then works backwards from this IMR limit to determine how much of your wallet balance and borrowing capacity is still available for placing new orders.

What is the Max. buying/selling amount in Spot Margin trading?

The Max. buying or selling amount is the maximum amount of assets you can buy or sell based on your available balance after considering the amount that can be borrowed.

What are the maximum borrowing limits?

To view the maximum borrowing limits of different coins under different VIP levels, refer to the Margin Data.

What will happen if my borrowing limit is hit?

If your borrowing amount exceeds 100% of the maximum borrowing limit, a penalty borrowing fee will be applied:

Penalty Borrowing Fee Payment = Borrowing Amount × Hourly Borrowing Fee Rate × (utilization ratio)3

The system will send you an email reminder, and your account will return to a safe level once your borrowing amount falls below 100% of the limit. However, if your borrowing amount stays at or above 100% for 24 consecutive hours, or reaches 200% at any time, the system will initiate an automatic repayment.

The auto-repayment will continue until the borrowing amount is reduced to 90% of the maximum limit. A 1% repayment handling fee will apply to the amount repaid automatically.

What is the borrowing fee rate for the borrowed amount?

The borrowing fee rate is updated hourly and can vary according to VIP levels. You can check your hourly borrowing fee rate for each coin here.

Hourly Borrowing Fee Charge = Borrowing Amount × Hourly Borrowing Fee Rate

How often will borrowing fee be incurred?

Borrowing fee will be generated once every hour. The system will auto-calculate and charge the borrowing fee five minutes after each hour, such as 8:05AM UTC or 9:05AM UTC, etc. This is based on the borrowing fee rate and the amount of borrowing at that time. Please note that less than one hour will be counted as one hour.

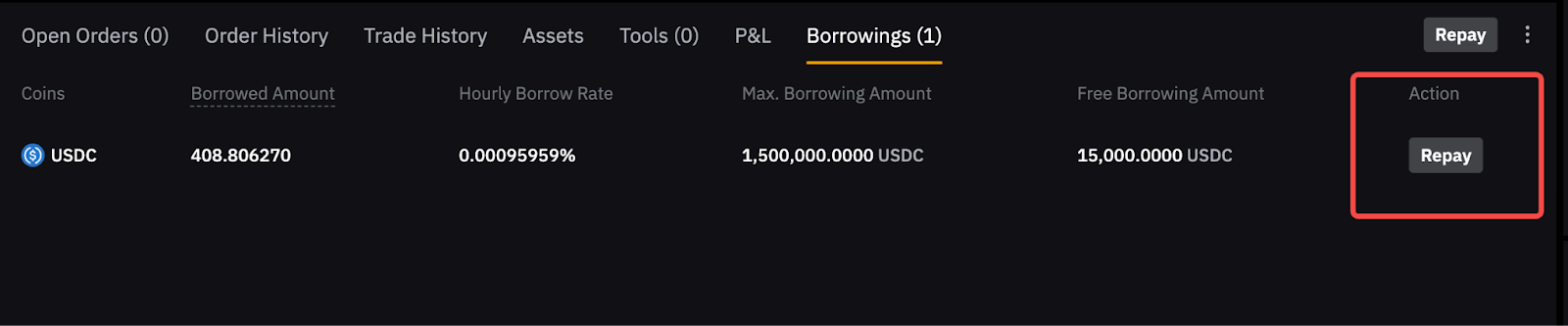

How to make a repayment?

You can repay your borrowings in the following ways:

- Automatic repayment – Transfer the borrowed amount to your Unified Trading Account. The system will automatically deduct it to settle your borrowings.

- Manual repayment – Go to the Borrowings tab or your Unified Trading Account asset page to make a repayment manually.

How to calculate the Initial Margin and Maintenance Margin required for Spot Margin Trading?

In Spot Margin Trading, both the Initial Margin (IM) and Maintenance Margin (MM) will be required for the borrowed amount. These margins contribute to your Unified Trading Account’s Initial Margin Rate (IMR) and Maintenance Margin Rate (MMR).

- Initial Margin (on Borrowed Assets) = Asset Borrow Size × IM Rate for Borrowed Asset

- IMR for borrowed assets = 1/Selected Leverage

- Maintenance Margin (for Borrowed Assets) = Borrowed Amount × MM Rate for Borrowed Asset

- MMR for Borrowed Asset = 4%

Is there any liquidation risk under Spot Margin Trading?

Yes, liquidation will be triggered when the Maintenance Margin Rate of your Unified Trading Account reaches 100%.

What will happen in the event of liquidation (MMR=100%)?

In the event of liquidation, any active orders will be cancelled, and an auto-repayment will be triggered. The system will partially repay the liabilities until the MMR returns to the 85%–90% range. If the partial repayment fails to bring the MMR within this range, a full repayment will be executed. Please note that a 2% handling fee will be charged for auto-repayment.

How to calculate the Maintenance Margin Rate?

Cross Margin: Total Maintenance Margin / (Margin Balance - Haircut Loss)

Portfolio Margin: Total Maintenance Margin / (Equity - Haircut Loss)

What is Haircut Loss?

Haircut loss refers to the reduction in an asset’s value when it is used as collateral. If the collateral value ratio is set below 100% — for example, 25% — it means only 25% of the asset’s market value will count toward your collateral. The difference between the asset’s full value and its reduced collateral value is the haircut loss.

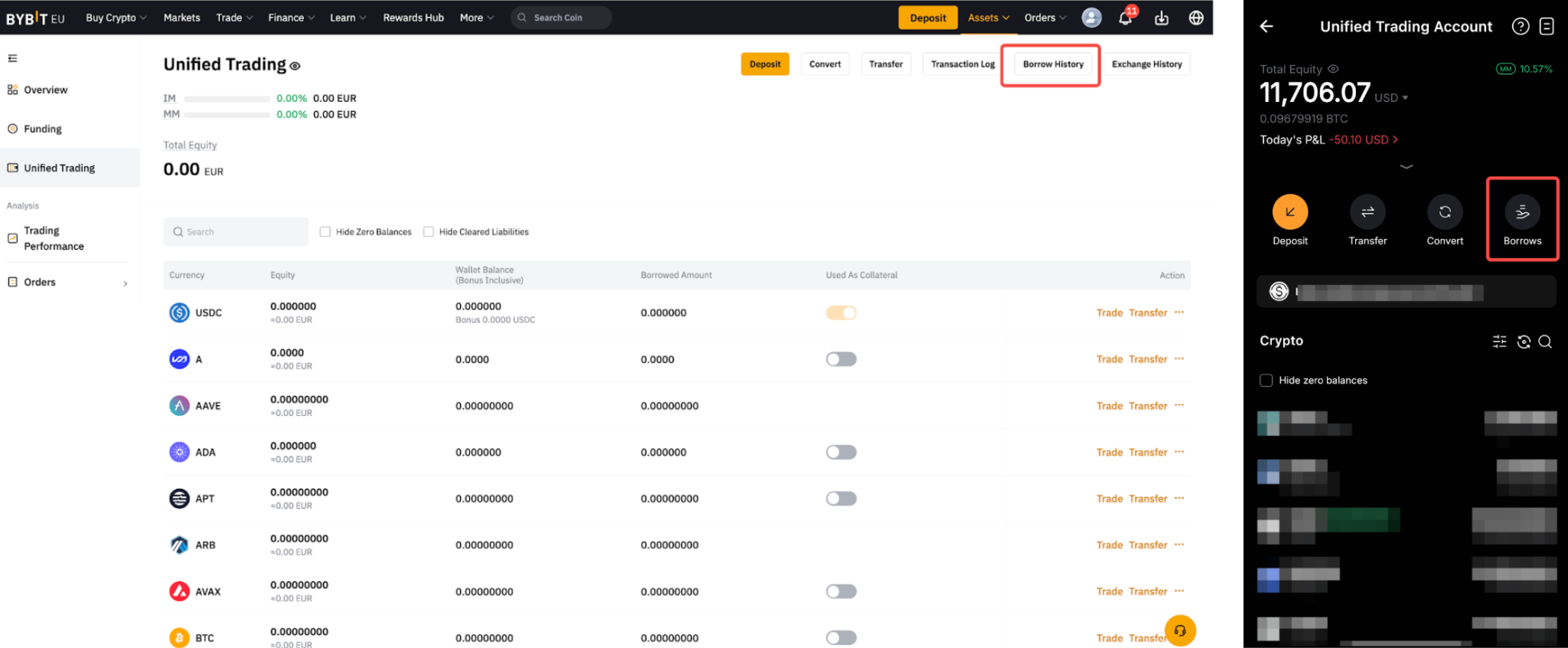

Where can I view my Borrow and Borrowing Fee history?

You can check your Borrow History from the Unified Trading Account asset page.

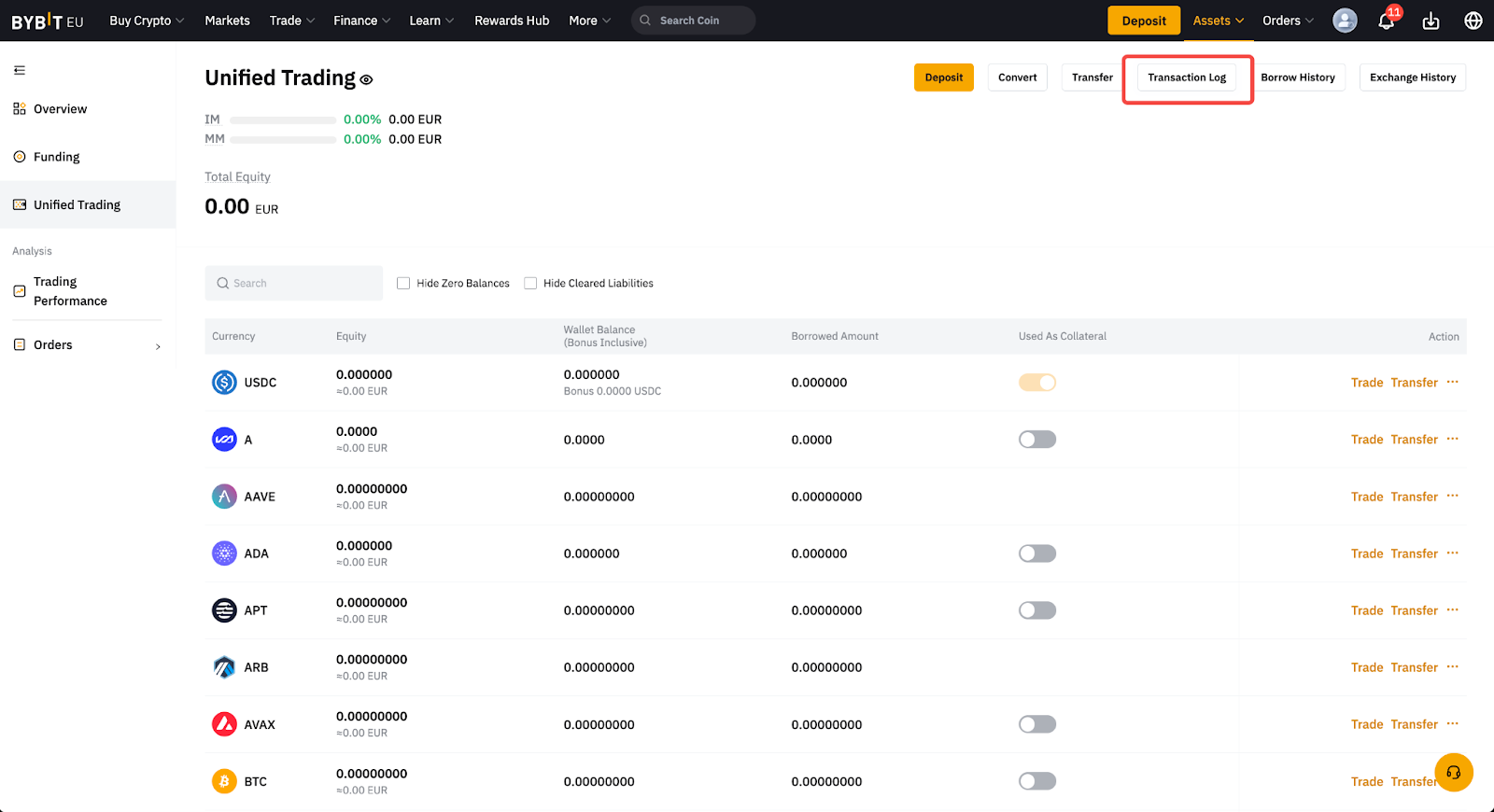

Where can I view my repayment record?

You can check the repayment details from your Unified Trading Account transaction log.