The Unified Trading Account (UTA) streamlines your trading with access to Spot Trading and Margin Trading. It allows traders to trade seamlessly without switching accounts. The supported margin assets in UTA can be collateralized, and a margin balance calculated in USD will be calculated. You can use the available margin balance to place orders across UTA's supported trading products, eliminating the need to hold specific settlement coins. It's a unified and efficient way to engage in multi-currency trading.

In this article, we will guide you through the Unified Trading Account Assets page.

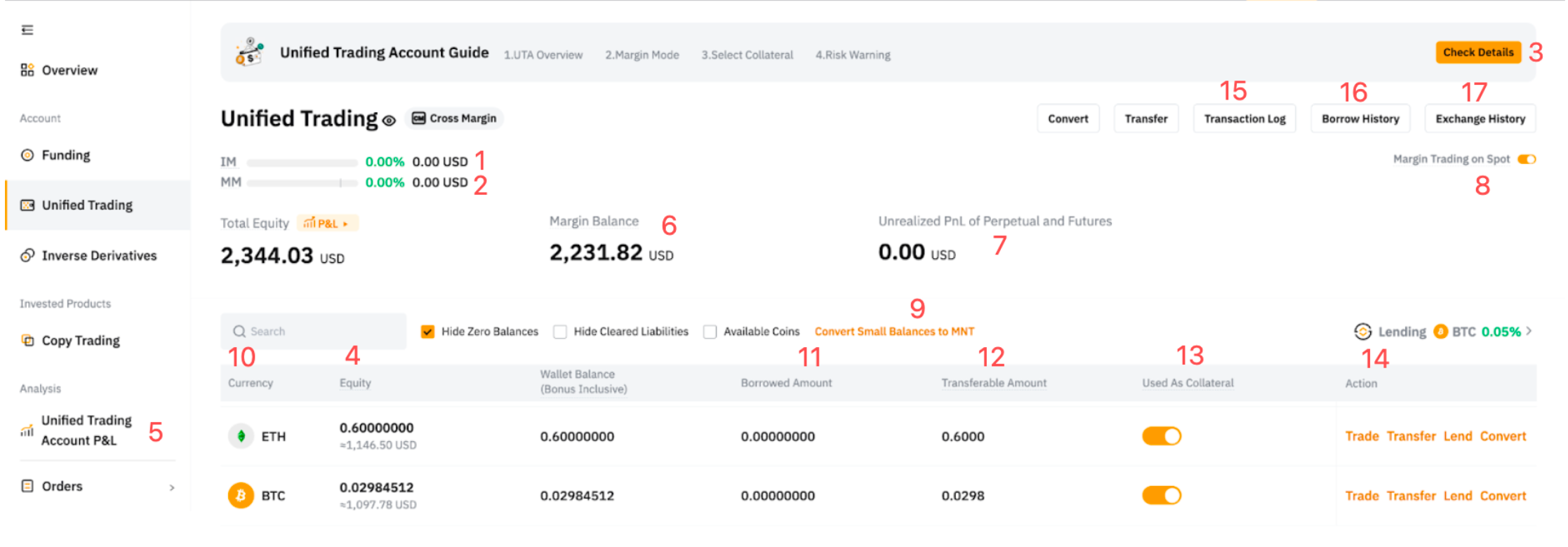

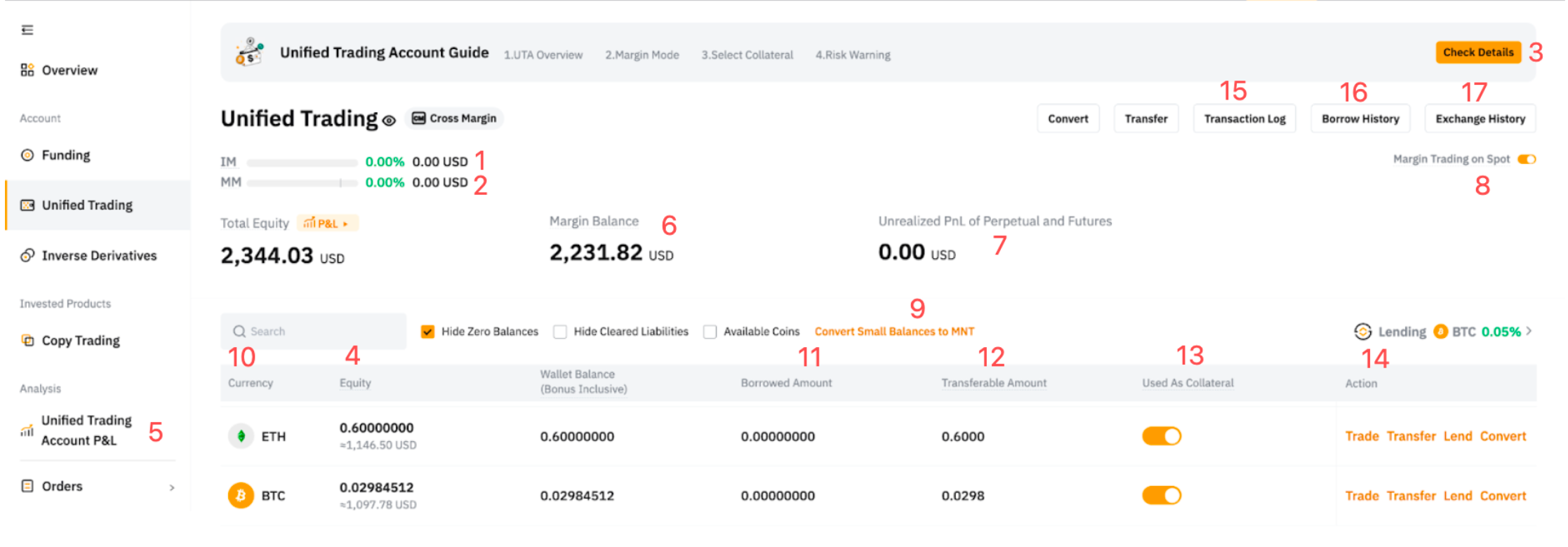

Unified Trading Account Overview

|

1

|

IM (Initial Margin)

|

Isolated Margin

Cross Margin & Portfolio Margin

-

IM refers to the total amount of margin required by all active orders and open positions under Spot Margin Trading, in USD.

-

If the IM Rate is ≥ 100%, it means that all margin balance has been fully utilized for your active orders and open positions. You will no longer be able to place active orders that may increase your position size.

-

USD Index Price = USDC Perpetual Index Price x USDC Conversion Rate

USDC Conversion Rate = BTCUSD Index Price / BTCUSDC Index Price

|

|

2

|

MM (Maintenance Margin)

|

Isolated Margin

Cross Margin & Portfolio Margin

-

MM refers to the minimum amount of margin required for holding positions in Margin Trading on Spot, in USD.

-

Liquidation may be triggered if your margin balance falls below your Maintenance Margin Level (i.e. MM rate is ≥ 100%).

-

For more information, please refer to the Glossary (Unified Trading Account).

|

|

3

|

Choose Margin Mode

|

-

You can switch your margin mode to either Isolated Margin mode, Cross Margin mode, or Portfolio Margin mode.

-

Please note that you must fulfill the criteria to switch the margin mode. For more details, please visit here.

|

|

4

|

Total Equity

|

Isolated Margin

Cross Margin & Portfolio Margin

|

|

5

|

P&L

|

|

|

6

|

Margin Balance

|

Isolated Margin

Cross Margin & Portfolio Margin

-

Margin balance is the total amount that can be used as the margin in your account. If the margin balance falls below the maintenance margin, liquidation will be triggered.

-

Do note that the value shown here is an asset value after considering the collateral value ratio on the wallet balance and not the actual USD amount held in your account.

-

Margin Balance = Wallet Balance

|

|

7

|

Margin Trading on Spot

|

Isolated Margin

Cross Margin & Portfolio Margin

|

|

8

|

Convert Small Balance to MNT

|

You can convert any assets worth 0.001 BTC into MNT. For more information, please refer to How to Convert Small Balance to MNT.

|

|

9

|

Currency

|

Crypto assets that are currently supported in the Unified Trading Account.

|

|

10

|

Equity

|

This shows the equity for the respective coin, using the same formula as total equity.

|

|

11

|

Wallet Balance (Bonus Inclusive)

|

The actual number of coins that you physically held in your Unified Trading Account, including any bonus.

|

|

12

|

Borrowed Amount

|

The amount that you have borrowed for that respective coin. For more information about borrowing and repayment, please visit here.

|

|

13

|

Transferable Amount

|

Isolated Margin

Cross Margin & Portfolio Margin

-

This value is an estimated amount of the coin that can be transferred, after considering the unrealized loss, initial margin required, frozen amount for active orders or borrowings, haircut loss and order loss.

-

Unrealized profit can be used for trades but cannot be transferred out.

-

The actual amount that can be transferred is subject to the real-time display in the Transfer window.

-

You will not be able to transfer out more funds from UTA when IMR reaches 100%.

|

|

14

|

Used as Collateral

|

Isolated Margin

Cross Margin & Portfolio Margin

-

You can choose whether or not to use certain assets as collateral. Only the USD value of the selected collateral assets will be included in your Margin Balance for Spot Margin Trading.

-

USDC serves as the default collateral and cannot be disabled. You can also manually select other assets as collateral.

-

Assets that are not used as collateral, can only be used for Spot Trading.

-

To learn how to customize your collateral assets, please visit here.

|

|

15

|

Action

|

-

This provides fast access to common functions to users such as Trade, Transfer, Repay or Convert.

-

Trade: It suggests popular trading pairs that use the selected coin as settlement currency

-

Transfer: This allows you to transfer the selected coin within your Main Account or across your Subaccounts. Read more on How to Transfer Assets on Bybit EU

-

Repay: You will only see the Repay button should you have any borrowed amount for that coin. Read more on How to Make Manual Repayment in Your UTA

-

Convert: You can convert your fiat or crypto into other currencies easily without conducting trades through the Spot market. Read more on How to Convert Your Assets.

|

|

16

|

Transaction Log

|

You can view the full asset change details in your Unified Trading Account from the transaction log.

|

|

17

|

Borrow History

|

-

You can view your existing borrowed amount, the respective borrow rate, the maximum borrowing limit, and its utilization ratio. For more details, please refer to here.

-

You can also view your borrowing history and interest accrued.

|

|

18

|

Exchange History

|

The Exchange History displays the conversion history of the repayment coin to the borrowed coin, resulting from either manual or auto repayment. For more details, please refer to here.

|

|

19

|

Available Balance

|

This indicates the amount available for trades. However, it is not displayed on the Assets page. Traders can view it directly from the order zone of the trading page. The available balance for different coins on Spot Margin Trading could be different due to the reason for haircut loss.

|